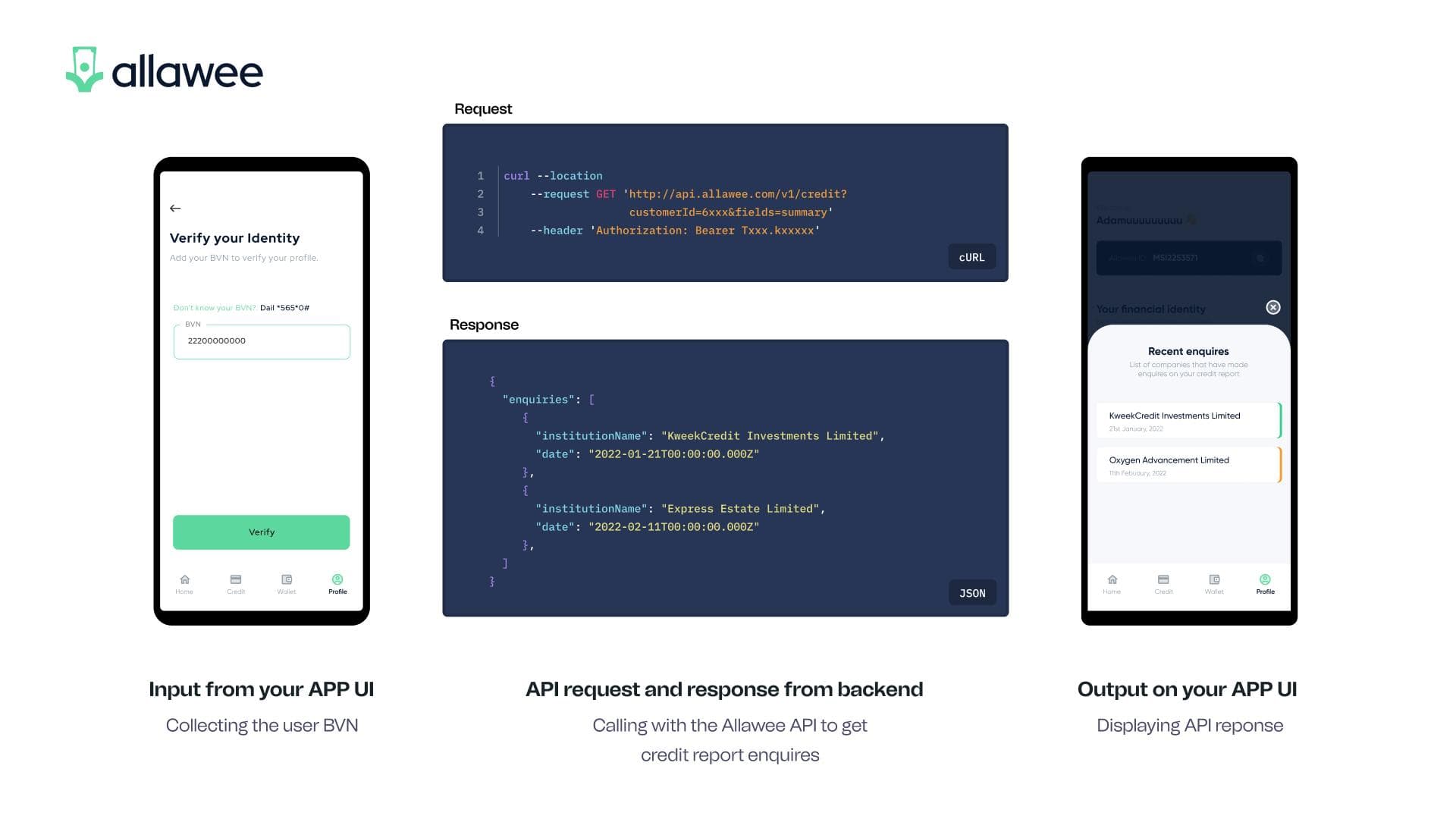

At Allawee, we have added both Enquiries and Payment history points to our list of API responses. With these features, you can enjoy ease-of-access and accurate financial data about your customers so you can make better informed credit decisions.

Enquiries

When a financial institution or a lender requests for a customer’s account history after they apply for credit or a loan, an enquiry is said to have occurred. Enquiries inform you on the number of institutions or lenders your potential customer has applied to before coming to you, this information can help you make better lending decisions. For instance, excessive account inquiries show that a person is about to rack up significant debt in the nearest future.

Through a single call, you can now get detailed information on potential customers, check enquiry lists and make better credit decisions. The API call also includes any institution that made the account inquiry. Therefore, you can easily decide if a customer was just considering their options or whether their different inquiries are part of a single transaction.

Payment History

This feature gives insight into every customer’s monthly repayment behaviour, providing information that shows how well they have handled their credits and loans in the past. With this information, you can find out if, or not, they default on credit, how often they default, and how long they default for. This information can help you find out if a potential customer is capable of fulfilling all credit requirements on time.

This information can direct all future decision making and enable you to accurately measure risk when it comes to your potential customers. View more information on our API documentation docs.allawee.com Get started by signing up here or contact sales & book a demo now.