Late last year, the topic of Payment Service Banks (PSB) re-entered the economic discussion. This was after the CBN granted an Approval in Principle (AIP) to Airtel Africa Plc. and MTN Nigeria allowing their subsidiaries (SMARTCASH Payment Service Bank Limited and Momo Payment Service bank) to operate PSBs.

Earlier in 2019, the CBN had granted Approvals in Principle to three new PSBs: Hope PSB (a subsidiary of Unified Payment), Money Master PSB (a subsidiary of Global telecommunications) and 9PSB (a subsidiary of 9Mobile Telecommunications).

A PSB is usually a subsidiary of a telecommunications company or a similar large B2C firm that acquires a license to provide financial services by leveraging its existing telecommunications or distribution infrastructure. PSBs are permitted to offer banking services such as deposit-taking, remittances, payment processing and mobile wallets.

The objective of these banks is to increase financial inclusion and depth in Nigeria by providing tailored financial products to unserved and underserved customers. Under the CBN guidelines, Payment Service banks are not allowed to grant any form of loans, advances and guarantees to customers (directly or indirectly), accept foreign currency deposits, deal in the foreign exchange market or provide insurance underwriting services.

Critics argue that the move of mobile-led mobile money has come too late:

We don't believe the approval is coming too late, or essentially, we believe it is a case of better late than never. Our reason for this is obvious, a lot of Nigeria's population is still not financially included when looking at the grand scheme of things. Ideally, the approval should have been granted earlier, but finally, it is here and we believe in its potential impact due to the sheer reach of the Telcos. Over the years, we have seen the impact of the Telco-driven model, just take a look at neighbouring Ghana. In Ghana, financial inclusion rose from 29% to 57% in the period between 2011-2017, according to the Findex data.

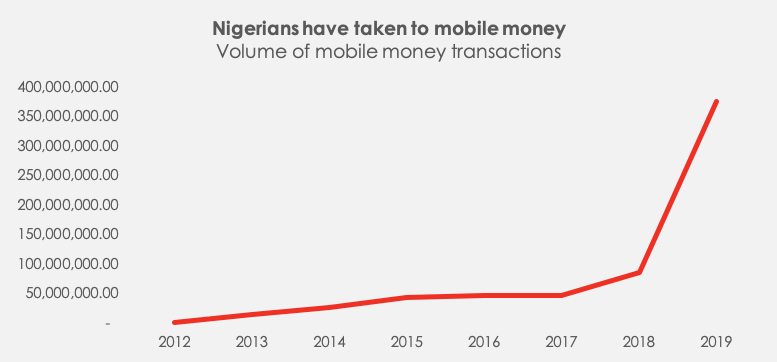

Source: CBN, Allawee

Do we see it as a move that will quicken financial inclusion? How?

The Nigerian Communications Commission (NCC) maintains that Telcos reach up to 98% in coverage and are present in all but one of the 774 local governments in the country. Commercial banks, on the other hand, only have 7 branches per 100,000 people in Nigeria (in 2020).

Essentially, allowing Telcos to offer minor banking services will improve financial inclusion. Nigeria's unique mobile penetration still prints in around 40%, way below the global average. Europe is at 86% and North America at 84%.