If you don't know anything about your credit score or the credit scoring system then you’re not alone. A lot of people are completely ignorant of this information until they decide to make a major purchase, buy a house, take a loan, or start a business. Without a good credit score, you won’t be able to do any of the above.

What is a Credit Score?

A credit score usually refers to a group of three-digit numbers that help lenders to decide if a person should get a credit card, a mortgage, a loan, the interest rate for the given credit or any line of credit available. This Credit score helps to paint the business, or lender, a picture of your credit risk when you apply.

Every person has an individual credit score. This means that whether you are married or partnering with another person in a business and you co-sign a loan, both credit scores will be analyzed individually. If either one of you appears to have a high risk potential to the lender, you’ll be less likely to get approved for the loan or credit you’re asking for. If you do get approved, then the credit will be priced at a higher amount, meaning that your transaction would incur a higher interest rate to borrow money.

You might be wondering, “How do I find out my credit score?”, “How do I get the credit score information of my potential customers who don’t know theirs?” To get an accurate answer to this question, simply request for your credit score or credit report from www.allawee.com

When it comes to taking a loan, all lenders or businesses have their individual criteria. Your stance in the face of this criteria heavily depends on which credit bureau your lender turns to for your credit information or score.

How does your Credit Score affect you?

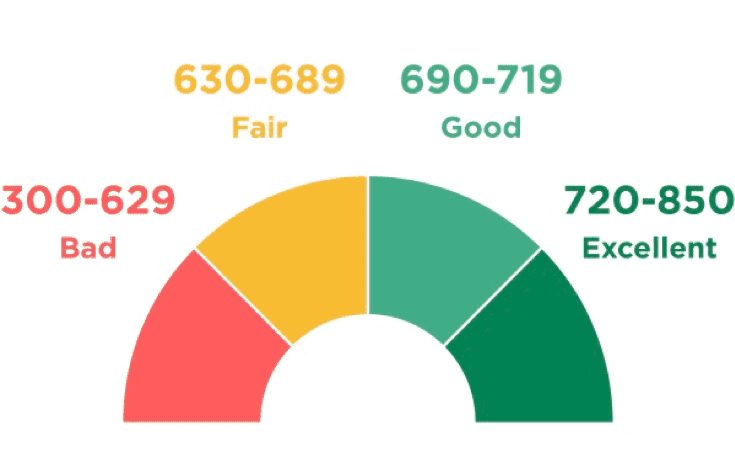

In order to fully understand the credit score range, anywhere from 300-850, you’ll have to understand what they mean.

The average credit score ranges from 300 to 850. According to the image above, credit scores between 300-629 are poor, 630-689 are fair and from 690 above is considered good credit. FICO and its major competitor, VantageScore both use this range in determining credit.

In Conclusion

Without a shadow of doubt, a good credit score allows for better credit management and wider financial options. You can not only reduce your cost of living with good credit, but you can save and invest more with the convenience it brings. By living within your means, taking debt seriously, paying all bills punctually and being financially responsible, you can shoot up your credit score and access a better financial lifestyle.