Although it might sound daunting to some, building credit isn’t as hard as it may seem. You just have to educate yourself on how to get started.

It is very important to know that good credit is a chief cornerstone for a healthy financial life both home and abroad. If you are a beginner at credit and trying to build your score from scratch, an ideal first step would be to establish your credit history. You could simply do this by getting added to or opening an account, often a credit card or loan, that is reported to one or more of the three major credit bureaus —- CRC Bureau Credit, CR Services Credit Bureau, First Central Credit Bureau.

The downside to having a non-existent credit history is that almost every company will want to verify your credit before agreeing to lend you some money or a credit card. Keep reading for some things you can do to start building your credit from scratch.

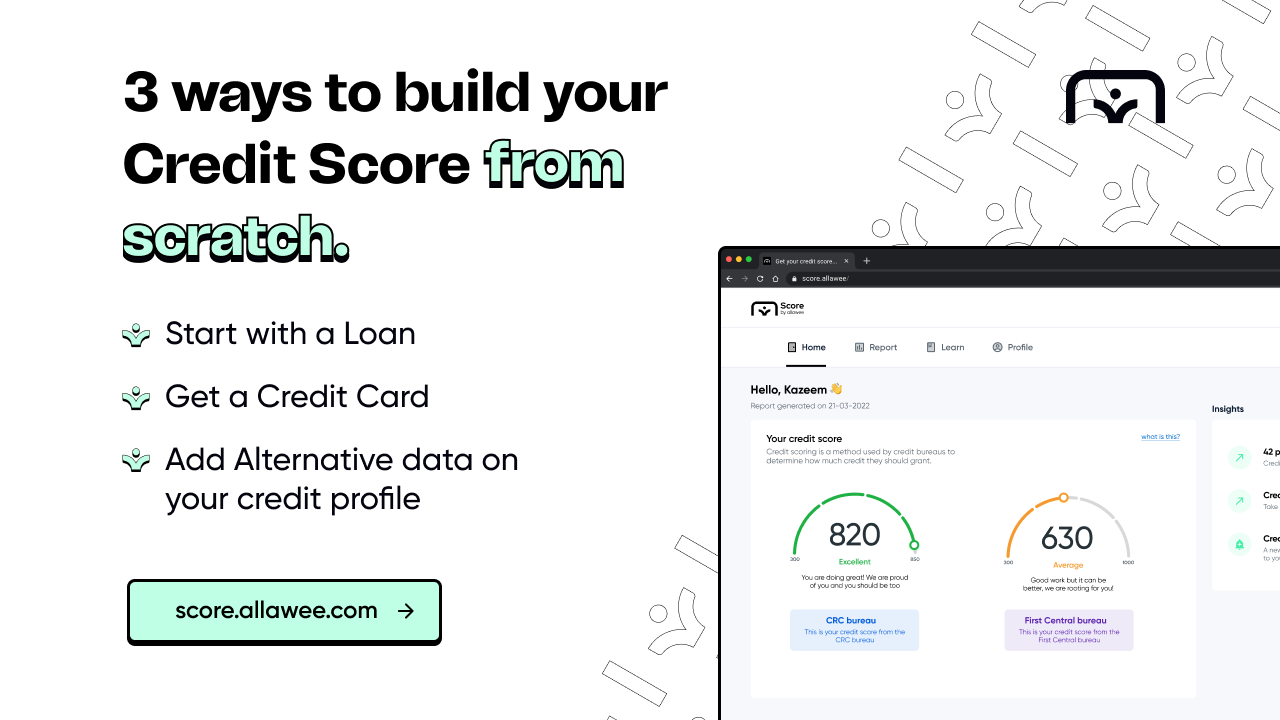

In this article, we will be highlighting 3 ways that can help you build your credit score from scratch, which are:

- Start with a Loan.

- Get a Credit Card.

- Add Alternative data on your credit profile.

Start with a loan

The easiest way to kickstart your credit history journey is to get a loan. Whether for higher education in the future, to start a business or to make a large purchase, taking a loan from a lender who reports to any credit bureau is an ideal way to begin building credit from scratch. However, you do not have to borrow money in order to pay interest just to build credit. But, if you have a major upcoming expense, it would be wise to take out a loan. This is a great long-term financial decision especially if you aren’t interested in credit cards.

There are different loan options to consider. The most important thing is to make sure that the lender is able to report the information to one or all three of the credit bureaus in Nigeria.

Get a credit card

On the other end of the spectrum, if you don’t fancy the idea of taking a loan then you can opt to get a Credit Card.

Before you decide to get a credit card, it is important to know that there are different types of credit cards. According to the purpose, building credit, you’ll want to choose a credit card that doesn’t mandate you to pay interest, carry over a balance or charge a yearly fee in order to start building credit.

To get a credit card, you’ll have to be 21 years of age or above. However, if you are under the age of 21 and you are a student, you will need a co-signer in order to get a card. If you are able to prove that you have a steady income then you might not need one. You could also get a credit card by being added to an account by an authorized user. This could be your parents, siblings or a trusted friend.

Some great credit cards worth vetting as an option for your first credit card include Secured credit cards, Student Credit Cards, Retail Credit Cards and ‘Cash-flow underwritten’ credit cards.

Whichever credit card you eventually decide to apply for, make a habit of using it to pay for what you can afford to buy. You can educate yourself further on the risks, benefits and the financial utility of this popular credit building tool by checking out more articles on our blog.

Add Alternative data to your credit profile.

Any data which isn’t represented traditionally on a credit report can be called Alternative data. This includes payment history for rent, cell phone bills or general utility bills. If you are trying to build credit, adding additional accounts that reflect on-time payments can go a long way especially since you have a thin file when you first start building credit.

If you include this data to your file and give it to the credit bureaus, they would be able to add it to your credit report. There are some companies who enable you to link eligible utility or bank accounts that can be reported to any of the credit bureaus. There are also services that allow you to add your rent payment data to your credit reports. It is important to know that with any alternative data, these reporting programs may report your information to one or two of the bureaus.

Now that you have gone through 3 of the best ways to build your credit score from scratch, it is important to note that it is impossible to have a credit score of zero. Although you can have no credit history meaning no credit score, it is not possible to have a zero credit. Most credit scores begin at 300 and start building from there so you can always start.

To Wrap Up,

While there are some nuances to credit, you definitely don’t have to be an expert to build credit. You can simply start by opening an account with a creditor that reports to any of the credit bureaus, and pay your bills on a timely basis.

A great way to keep up with your credit score is by using Score. This is a great credit score service that provides access to bureau certified credit scores and helps you track your credit conveniently. You can easily check your free credit scores here.

If you’re diligent, you’ll get there in no time and start reaping the benefits of having a high credit score.